KFP Market View in August 2020

Pandemic records

As economic data for Q2 comes in, mainly negative records on growth, corporate earnings and other measures are being set daily – as expected perhaps given the severity of the economic impact of lock down measures in many countries.

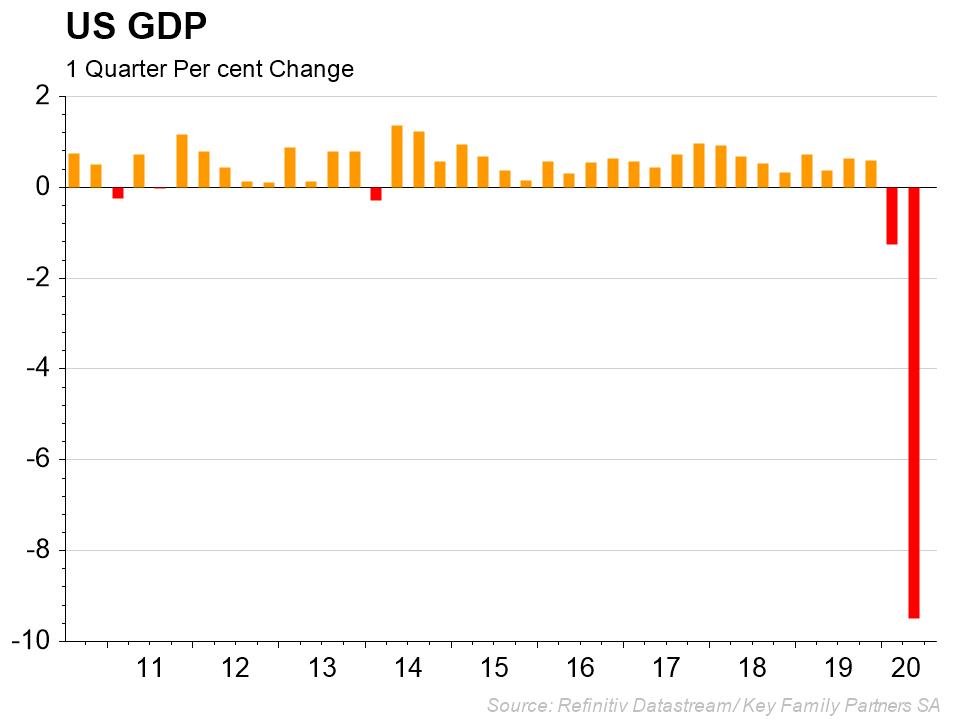

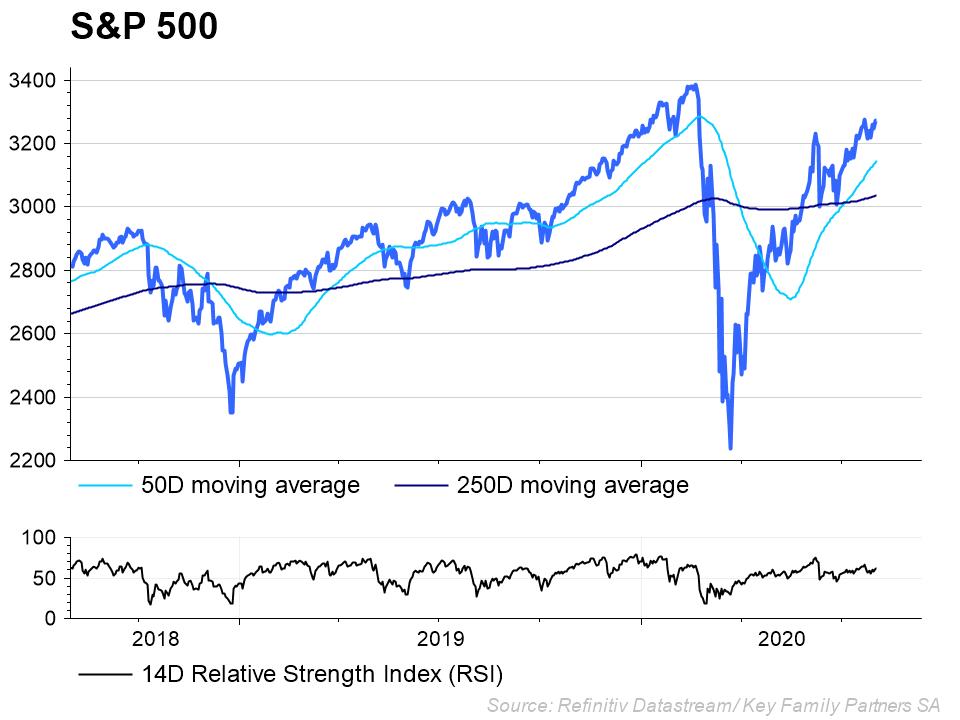

In the US, Q2 GDP growth fell at an ANNUALISED rate of -32.9%, leaving the economy -9.5% smaller than in the same quarter in 2019 and back to 2014 real GDP levels. This rate of contraction is the fastest ever seen and confirms the severity of the recession seen in the US. Q2 corporate earnings are down -39.1% on prior year, based on S&P 500 earnings releases to date.

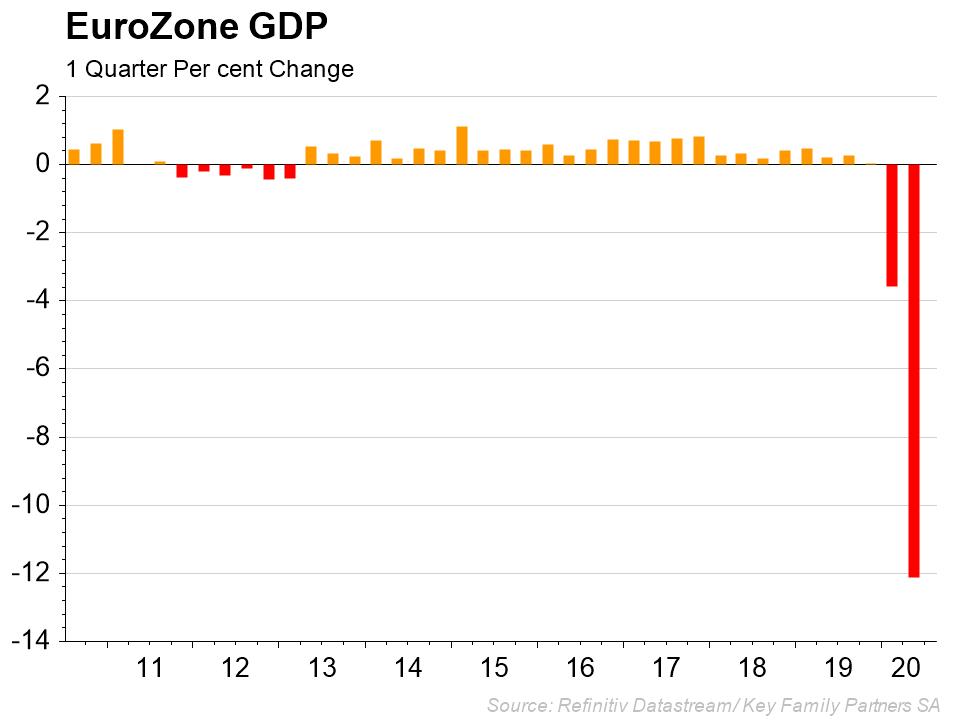

In the EZ, a similar story has been written where the economy contracted -12.1% in Q2 over Q1, which was also negative by -3.6%. Again, this was record territory for the EZ economy.

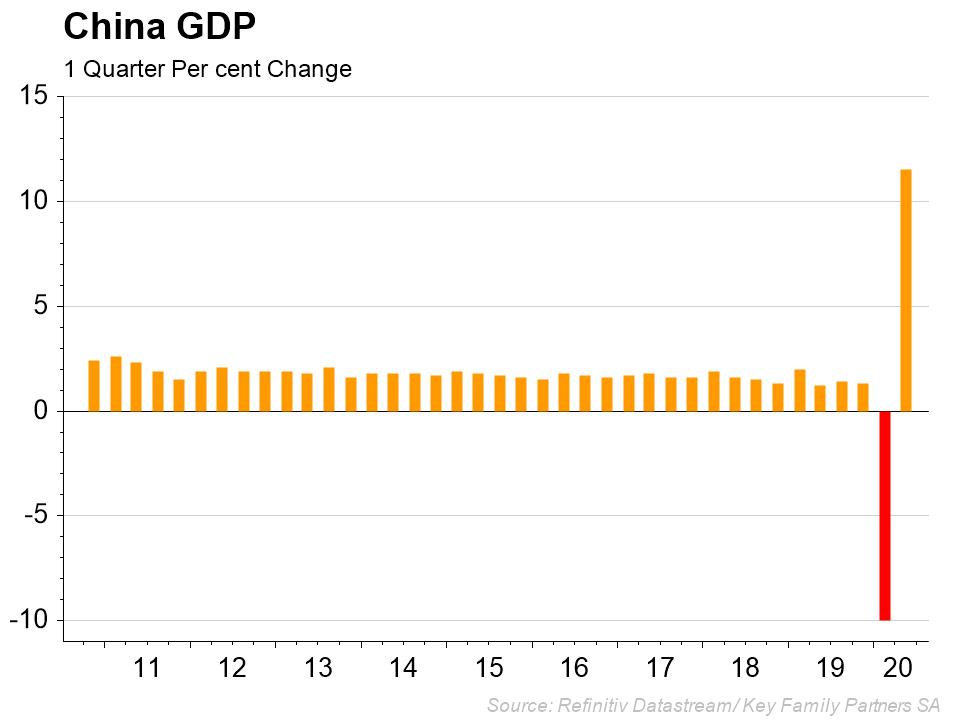

By contrast, China set a record for quarterly GROWTH in Q2 at +11.5% while maintaining an annual growth rate of +3.2%. (We can only wonder at how this has been achieved while the rest of the world remains in the grip of economic contraction over the past 6 months.)

In spite of the above, economic activity has started to pick up from the lows of Q2 in the US, EU and UK – all delivering composite PMI figures of greater than 50 for July, with Japan a shade below.

This seems to confirm that the recession has technically come to an end, in spite of the awful Q2 GDP numbers. Whether this recovery continues to gather pace will largely depend on the progression of the pandemic and lock down measures and there is some evidence that the pace of recovery has actually SLOWED in the last two weeks, particularly in the US as confirmed by the recent Fed meeting comments. The pandemic continues to expand globally and is re-appearing in countries which thought they were clear and have re-imposed lock down measures.

I believe these factors support the view of a slow, uneven economic recovery (the Swoosh), rather than the more optimistic “V” recovery some have suggested. We may only be at the end of the beginning of the crisis.

Currency upheavals

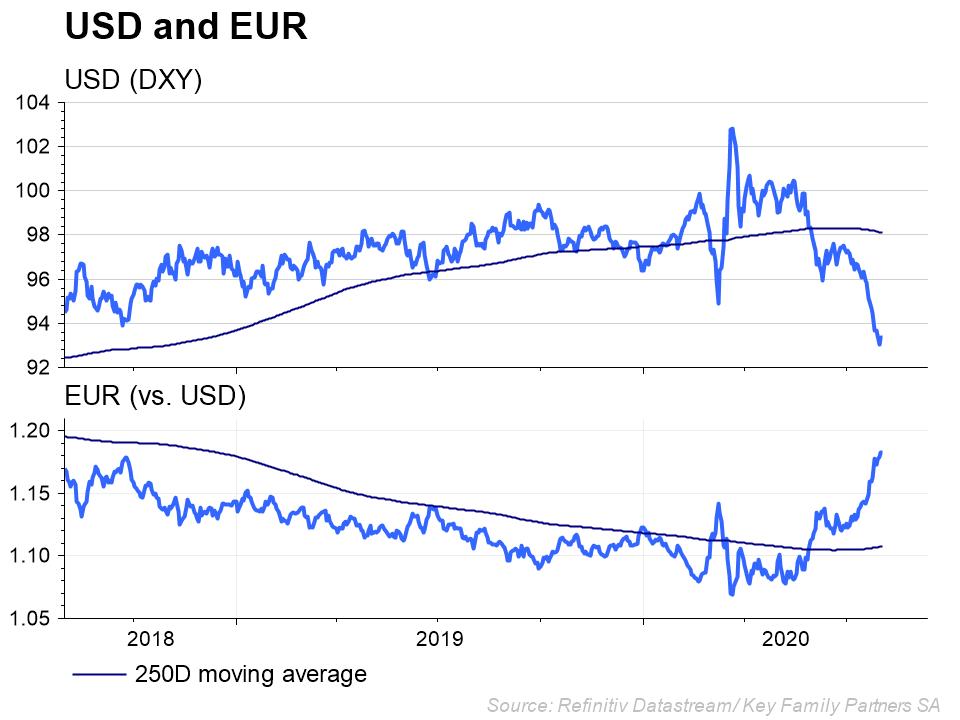

Amongst the many substantial economic developments, currency markets are delivering their own shock to the global system – a weaker USD against DM and EM currencies.

After 5 years of a strong(er) USD vs major currencies, a significant change to the outlook for the currency has developed. From a purely technical perspective, an important trend change has taken place with the currency level against the DXY Index of leading currencies. Both the currency and 50 and 200 moving averages are now in steep decline, a strong negative signal for the longer term. After a period of resilience and strength against other majors, and in particular the Euro, why should the USD see a longer term correction?

Numerous factors have come together to create something of a perfect storm for the USD. These include:

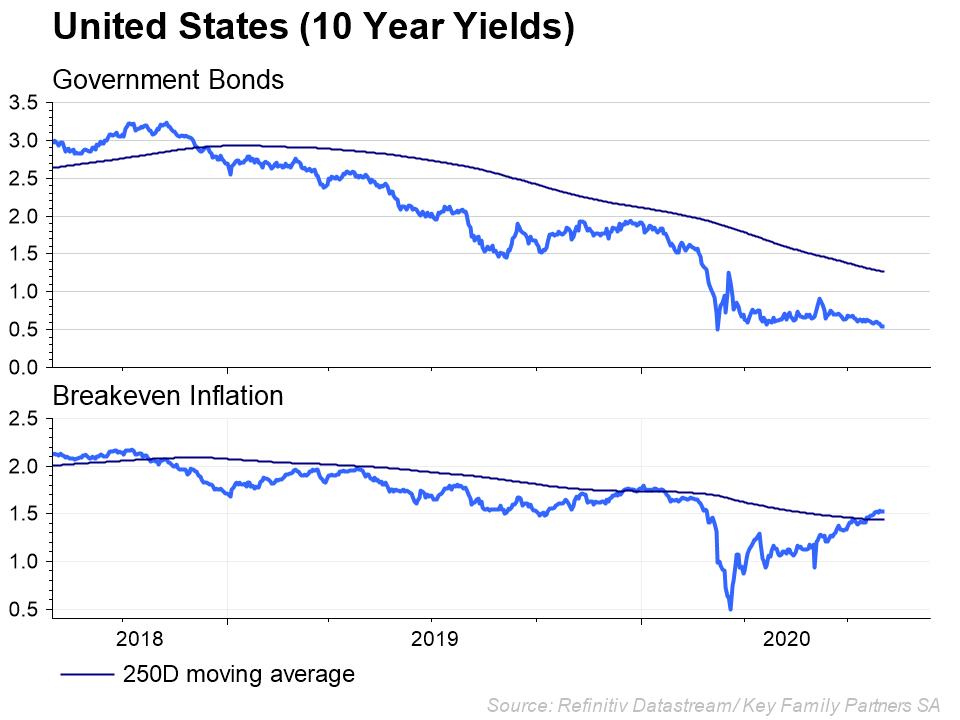

- Record monetary and fiscal easing in the US, which has seen interest rates pushed to almost zero, giving the USD yield little advantage over other currency yields. The attraction of the USD as a global savings vehicle has fallen.

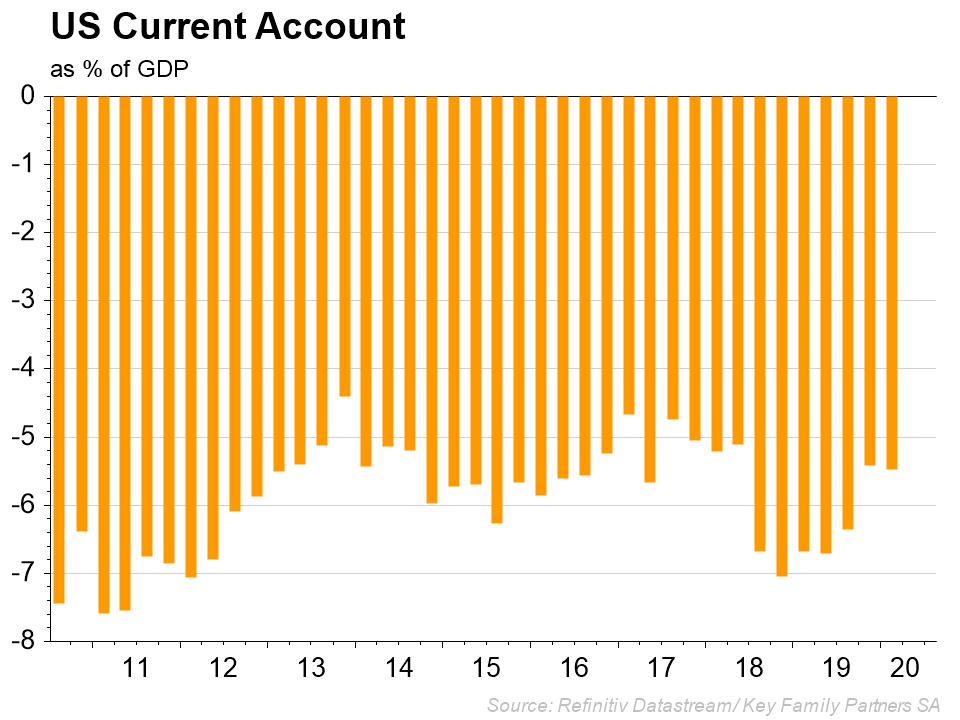

- The US current account deficit is on the rise again after a long period of modest deficits in the last decade. As the deficit expands, so increased volumes of USD enter the global economy providing the necessary USD to meet financial obligations (ie debt) outside the US. In addition, currency swap arrangements between the Fed and other Central Banks have ensured a ready availability of USD around the world.

- The EZ has made a major stride in confirming the durability of the Euro with the recently announced EU issued Covid support bond. While the size (€750billion) is modest compared with US stimulus, it is the first major step towards socialising the economic risks of some EZ countries (Italy and Spain in particular) amongst all EU members.

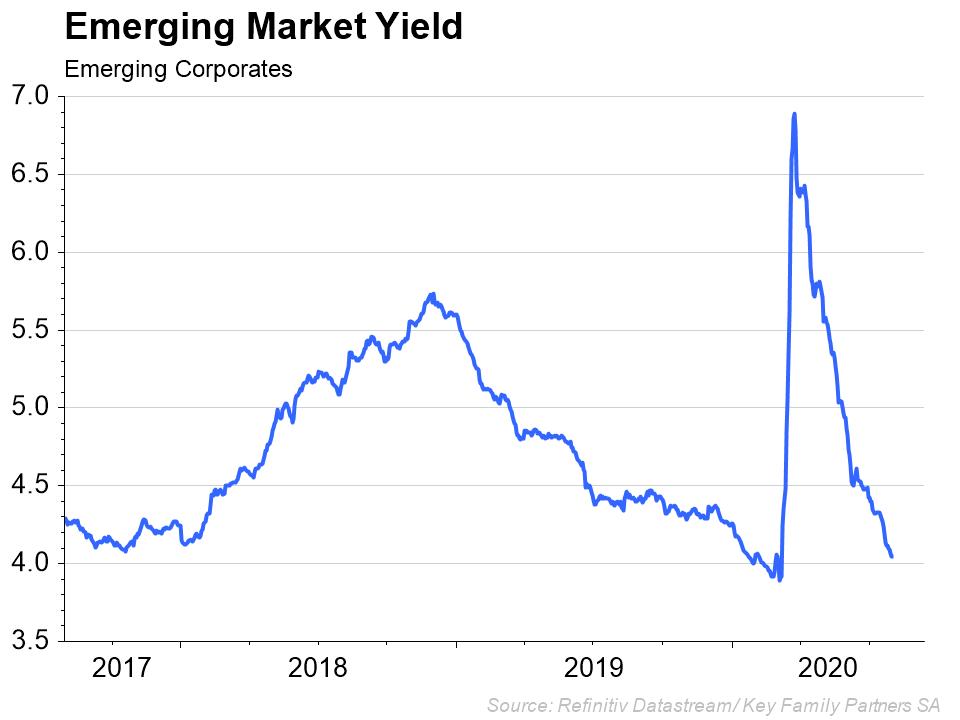

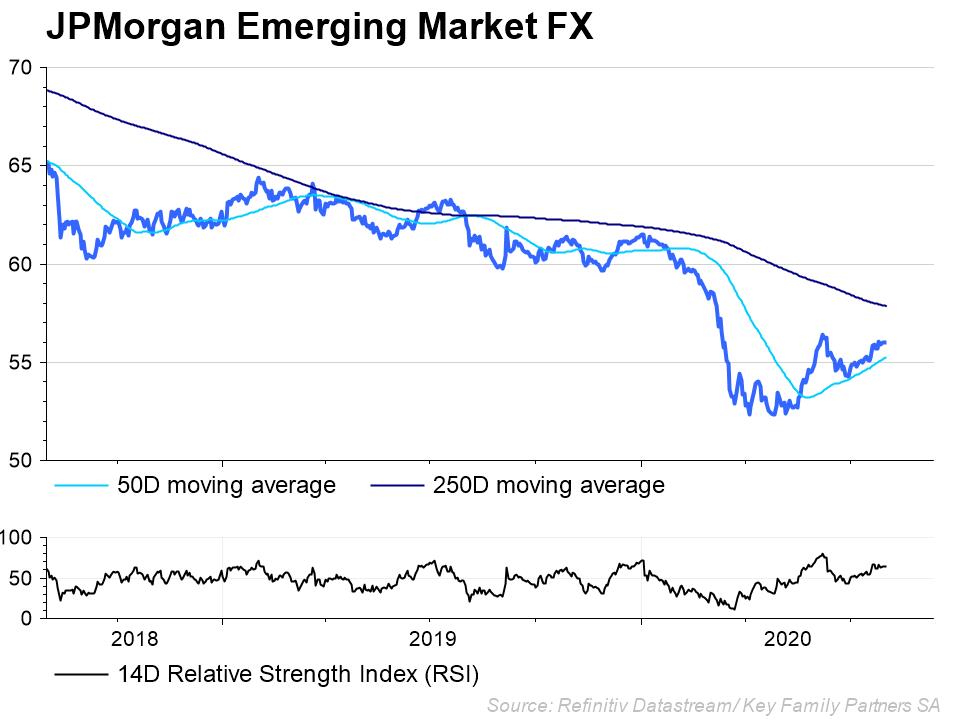

- China and most large EM’s have maintained positive nominal and real interest rates during the crisis, thereby improving the attractiveness of these currencies, assuming no default risk.

- Political upheavals in the US. This year’s election outcome remains uncertain and under various scenarios could destabilise the country for a considerable period. This is not an environment for a strong currency.

And what about gold?

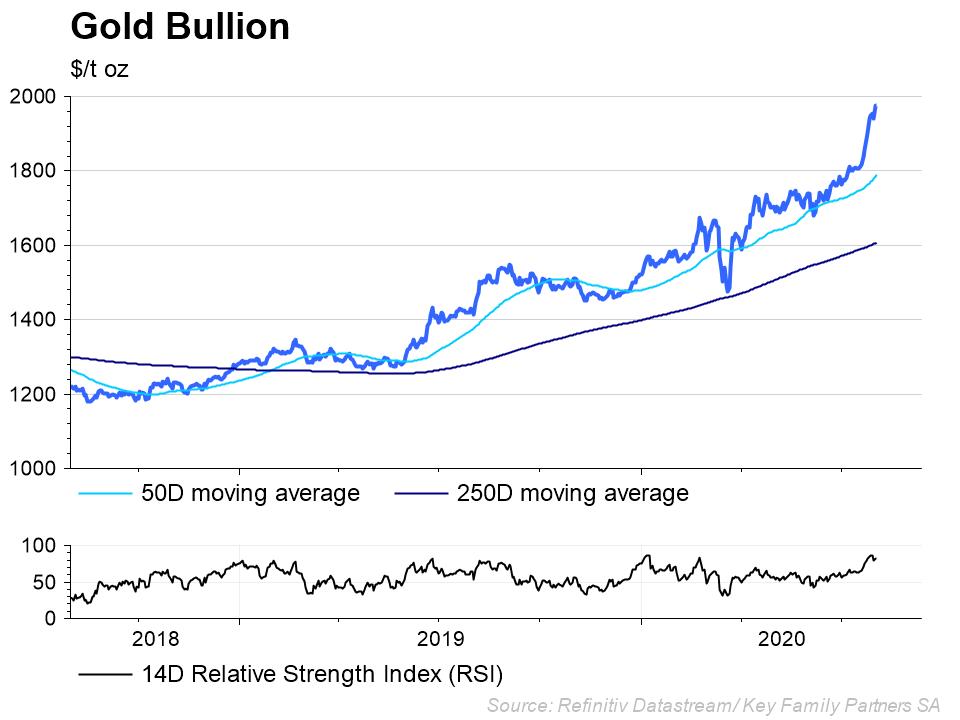

As gold smashes through its previous high seen in 2011, the question is how far can it go?

Short term the market is very over stretched but longer term, fundamental forces are at play which should continue to drive demand for gold, and hence prices, upwards. These include:

- As a currency, gold looks attractive vs the Euro, Yen and USD, which today offer negative REAL yields, and negative NOMINAL rates (except the USD). Thus the yield penalty of holding gold as a currency is no longer a factor.

- China has been seen to be buying aggressively (although hard to quantify the precise amounts) to support its global master plan to have a currency with substance (even a parallel reserve currency) for trading outside the USD sphere. Gold is the ideal (and only) credible backing.

- Gold is an excellent diversifier for investment portfolios, and institutional investors typically have very small or zero gold holdings. This view is changing as more institutional investors start to diversify into gold from a low level.

- Retail investors once again see gold as a safe haven against currency debasement from money printing. ETF demand, with only half a year gone, is already at a record annual high. Year to date, western institutions have bought 880 tonnes of gold (worth $230 bn) in ETFs – about half of global mine production.

- Finally, longer term momentum remains very strong, even allowing for a necessary cooling off after the recent powerful move.

Gold can therefore move higher, even a lot higher, from here while these factors remain in play.

For investors…

The uncertain pace of the economic recovery continues to provide a challenge for portfolio investors. Further diversification into non-USD assets and gold provides some protection in this unstable environment.

Download the Monthly Market View here

Key Family Partners SA is a multi-family office based in Geneva, Switzerland. We serve our members with investment services, financial planning, administration, succession planning, education and philanthropy. Contact us at KFP@keyfamilypartners.com ~ +41 22 339 00 00 ~ Rue François-Bonivard 6, 1201 Geneva. https://www.keyfamilypartners.com/

This article may contain confidential and proprietary information. Any unauthorised disclosure, copying, storage or use of this presentation may be unlawful. The content of this presentation does not constitute investment or financial advice and may not be relied upon as such. It does not constitute an offer or invitation for the sale or purchase of services or securities and shall not form the basis of any contract. Key Family Partners SA does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Key Family Partners SA is a private limited company with its registered office at Rue François-Bonivard 6, 1201 Geneva, registered with the commercial registry of Geneva under the IDE Nr. CH-395.573.747. KFP is a member of the Swiss Association of Asset Managers (SAAM).