KFP Market View in March 2021

GLOBAL ECONOMY

Warning – Inflation Returns

The past month has seen a rapid rise in longer dated Government bond yields in all G7 countries as inflation fears finally began to impact financial markets. Investors sold Government and Investment Grade fixed income instruments, pushing up yields and leading to losses of up to 10% on longer dated Treasuries in the month.

This development has been well signalled in our past few reports, but perhaps the surprise has been the speed with which the market has moved over the past month across all G7 markets in the face of rapidly rising inflation expectations.

Inflation numbers are starting to show up in the most recent data with CPI in all major economies rising in January, most notably the Eurozone moving to 0.9% from -0.3% in December. The US posted 1.4% in January, the highest level since March 2020 – and rising.

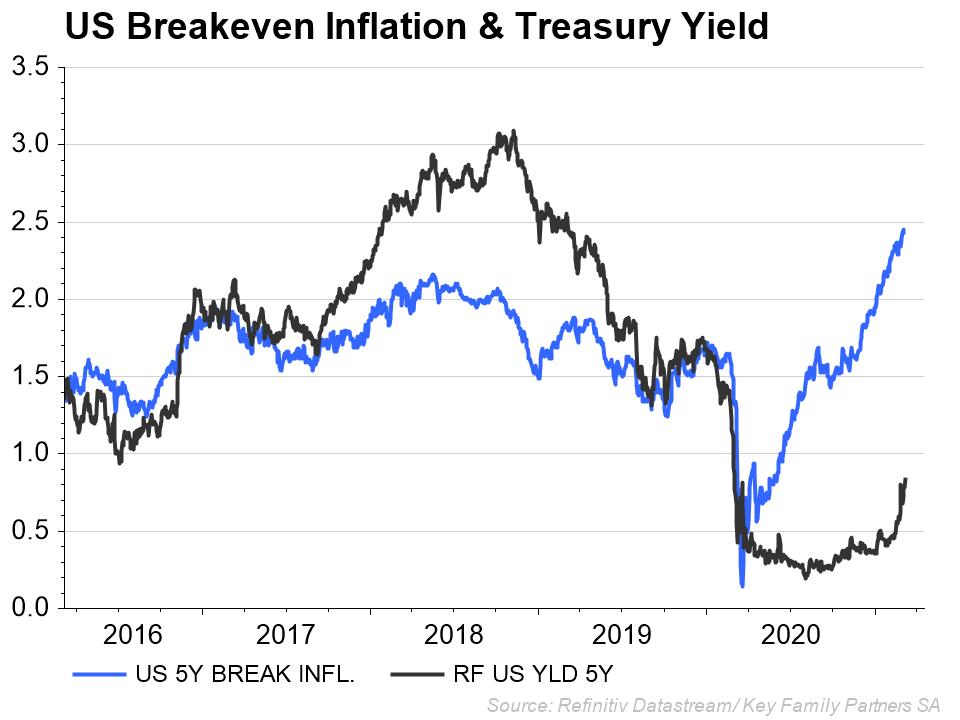

While these numbers are not yet of concern per se, the inflationary EXPECTATIONS are. The 5-year break even US inflation expectations (blue line) have risen to the highest level in 8 years and remain on a strongly rising trend. Yet yields on 5-year Treasuries (black line), which normally would trade at a premium to inflation expectations, have fallen to a substantial discount – a direct measure of the impact of the ‘super Keynesian’ monetary and fiscal policies being conducted by the US and other developed economies, and covered in our previous reports. The bond ‘vigilantes’ have recently moved to close this gap, but REAL rates remain strongly negative across the yield curve, except for the ultra-long 30-year Treasury yield.

The issue for markets, and investors, is what happens next? Do the market rates continue to rise to catch up with inflation expectations, or do inflation expectations fall to meet market interest rates – or some of both?

Interest rates – Quo Vadis?

Central Banks (CB) actions will be critical in the near term in determining the direction and level of market interest rates. Currently, all G7 CBs remain dove-ish on growth and inflation, and have reduced SHORT term rates to near zero, or below, using QE bond buying programmes to artificially reduce market rates to these levels. What we are now seeing is market driven yields rising at the longer end of the yield curve, where the CBs have not been particularly active, if at all, in holding down rates.

The dilemma for CBs is whether to let the yields rise at the longer end and hence increase the cost of borrowing for longer term borrowers (e.g. mortgages) – which would contradict their objectives of reflating their economies with cheap money and letting inflation run higher. Or should the CBs introduce active YIELD CURVE CONTROL by buying bonds at the longer end thus keeping interest rates down and real interest rates negative?

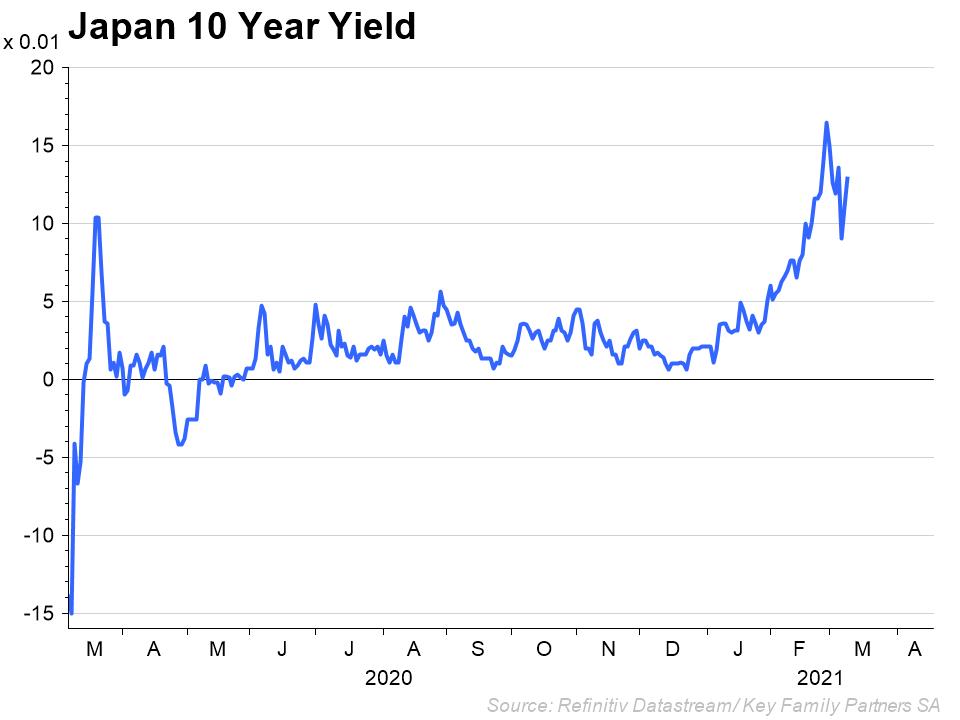

CB action on Yield Curve Control is the big unknown in bond markets today in the face of rising inflation expectations. The Fed has not yet given any such indications, while the ECB has flagged concern at the rise in longer term rates and given a strong indication that they will not let these rates rise. The BoJ has been doing this for years while the BoE has “discussed” using these measures.

These decisions matter hugely for investors, as without intervention by CBs yields can be expected to continue to rise towards the higher inflation expectations (and bond prices to fall), and economic recovery would slow. This would be negative not only for Fixed Income assets, but also highly priced growth equities, commodities and real estate as borrowing costs would rise and discount rates increase on future corporate earnings.

On the other hand, if CBs intervene to keep yields low (and real yields negative) the bull market in real assets could be expected to continue as the economy continues to recover from the recession in 2020 – and the CBs meet their economic goals.

Inflation – continuing to rise

“Super Keynesian” monetary and fiscal measures remain in place. Boosted by the US Administration’s recent $1.9trillion fiscal stimulus, they will continue to fuel inflationary pressures.

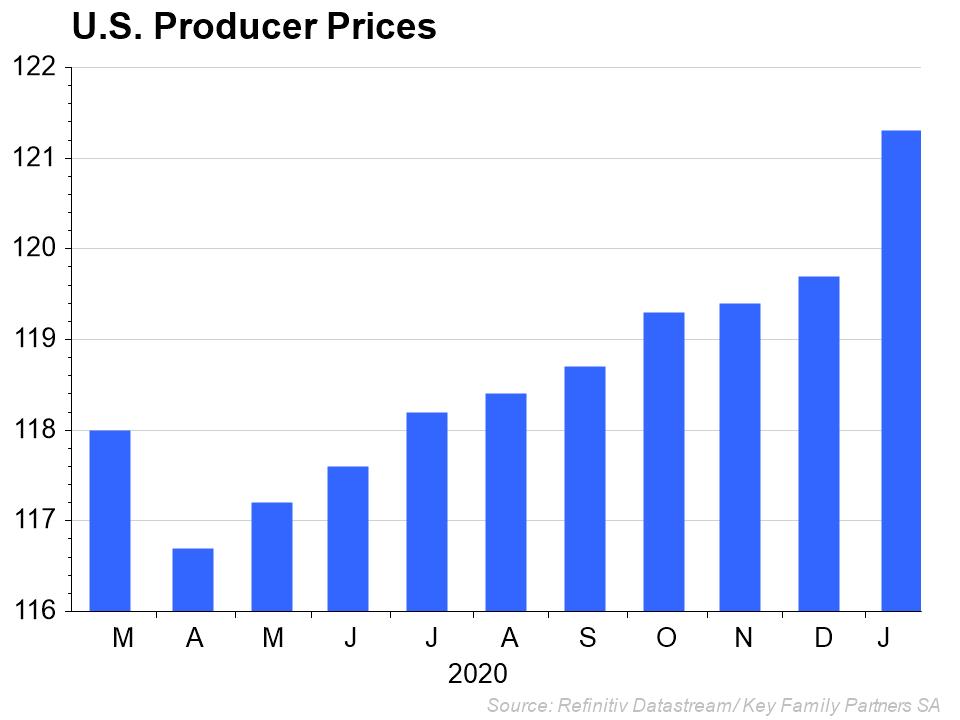

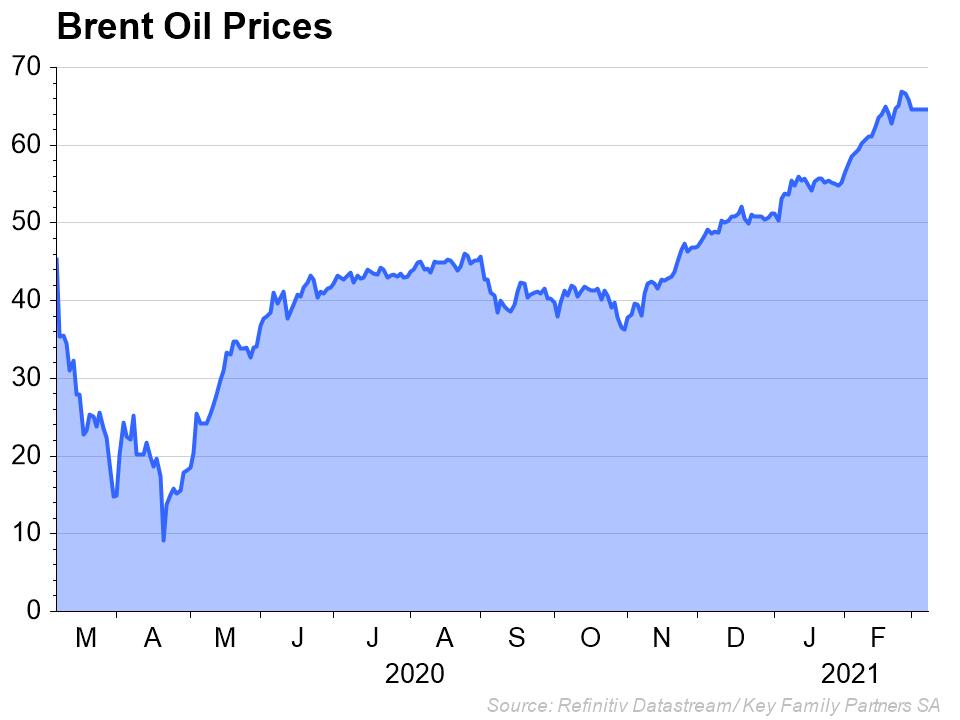

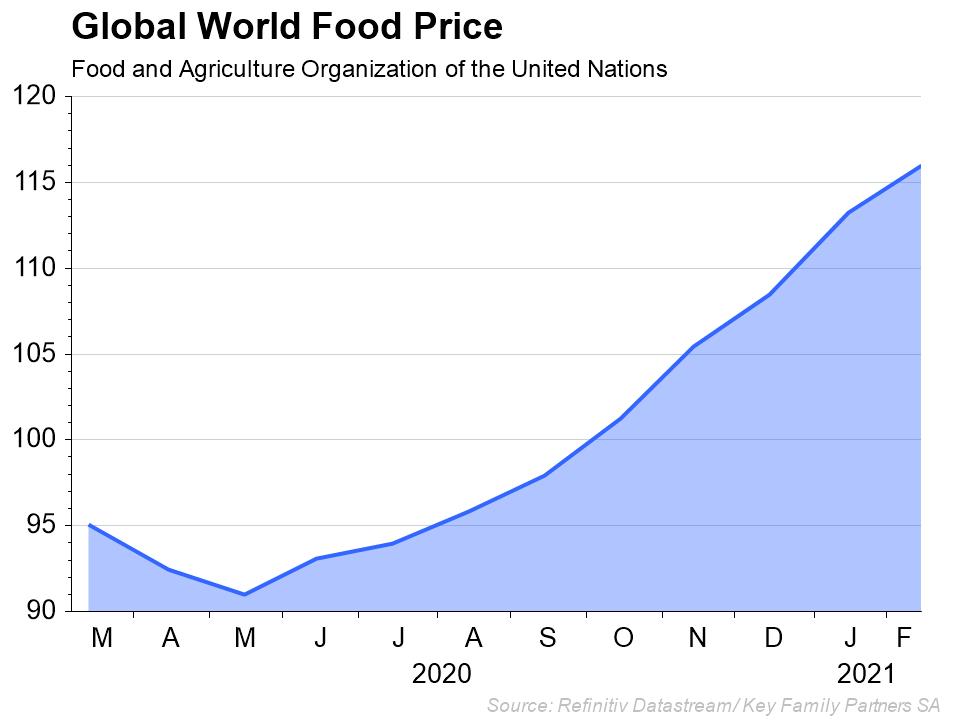

While inflation year-on-year remains below the average 2.0% target of the Fed, rising medium-term inflation pressures are visible in many areas:

Over the next quarter, headline inflation numbers will also be boosted by the “base effect” – essentially the impact of comparing today’s prices with the unusually low prices seen in the recession last year. Beyond that, the course of inflation will depend on the rate of economic growth (demand growth) and the ability to meet that demand (supply). Demand continues to be boosted by monetary and fiscal measures, while established manufacturing supply chains have been disrupted by the pandemic and political factors. Service industries have contracted due to insolvencies, reducing supply of both manufactured goods and services. Meanwhile labour costs continue to rise in spite of high levels of unemployment (+2.6% year on year in the US in Q4 2020).The challenges to achieving this level of new production are huge, and delays have already given rise to serious political issues between the UK and EU.

Growth – Continuing recovery

Economic recovery continues with the Citi Economic Surprise Index remaining well into positive territory for G7 countries, suggesting that economic data continues to be better than expected in G7 countries. Composite PMI numbers for February (where available) continue to show improving trends, with strong positive numbers in the US (58.8). Manufacturing PMIs for February were strongly positive, particularly in the US (58.5) and Eurozone (57.7).

These numbers reflect the continuing recovery in the G7 countries from the recession of 2020. China on the other hand had not (apparently) seen such an extreme economic contraction and has already recovered to pre-pandemic levels of GDP.

While economic growth remains strong (+6.5%) for Q4 2020 over the previous year, positive economic surprises remain low (CESI +2.5).

In summary

- Economic growth and recovery remain broadly on track

- Inflation has picked up and will continue to rise through Q2 putting pressure on G7 Central Banks to implement further YIELD CURVE CONTROLS.

For Investors…

- CB action to control market driven interest rates will be important for markets in the near term.

- With rising inflationary pressures and market interest rates, circling out of highly priced growth equities to lower priced recovery (value) equities makes sense

- Government and investment grade bonds will remain under pressure UNLESS G7 Central banks deploy yield curve control (YCC) in serious quantities.

- Real assets continue to be attractive over G7 fixed income assets assuming YCC action.

For more detailed commentary on each major market or asset class. Download the full Monthly Market View HERE.

Key Family Partners SA is a multi-family office based in Geneva, Switzerland. We serve our members with investment services, financial planning, administration, succession planning, education and philanthropy. Contact us at KFP@keyfamilypartners.com ~ +41 22 339 00 00 ~ Rue François-Bonivard 6, 1201 Geneva. https://www.keyfamilypartners.com/. Member of European Network of Family Offices – ENFO.

This article may contain confidential and proprietary information. Any unauthorised disclosure, copying, storage or use of this presentation may be unlawful. The content of this presentation does not constitute investment or financial advice and may not be relied upon as such. It does not constitute an offer or invitation for the sale or purchase of services or securities and shall not form the basis of any contract. Key Family Partners SA does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Key Family Partners SA is a private limited company with its registered office at Rue François-Bonivard 6, 1201 Geneva, registered with the commercial registry of Geneva under the IDE Nr. CH-395.573.747. KFP is a member of the Swiss Association of Asset Managers (SAAM).