KFP Market View in July 2021

GLOBAL ECONOMY

Growth RATE slowdown ahead

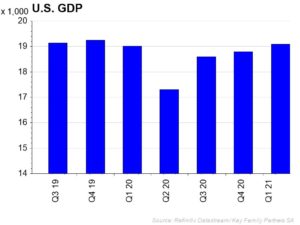

GDP growth numbers for the quarter just ended (Q2, 2021) are likely, once the data is released, to shoot the proverbial lights out across developed markets. Annualised growth for the US is expected to exceed 10%p.a.

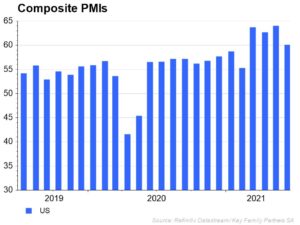

In the meantime, we can see real time “nowcast” PMI numbers reaching record levels for manufacturing in the US, EZ, UK and to a lesser extent Japan, during Q2. Service sector PMIs have followed a similar track, but at a slightly lower level. The Composite PMI chart for the US shows the overall impact.

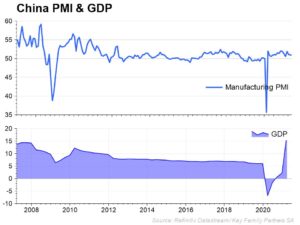

The one large outlier from this picture is China, where a growth rate slowdown has already set in according to the latest manufacturing PMI numbers. This makes sense, as China was the earliest economy to emerge from the 2020 recession, and has not provided the same level of fiscal and monetary support as the developed economies.

Looking ahead, however, economic growth at the rate seen in the first half of this year is unlikely to be repeated in the second half.

NB: There is no suggestion of renewed recession (at this stage), rather a moderation of the exceptional growth we have seen as the world economy recovers from the recession of 2020.

There are numerous reasons to expect the coming slowdown:

- As most economies reach GDP levels seen before the pandemic, the rate of recovery will slow and growth rates will move back towards longer term trends, which in the case of the US is 2.0%-3.0% annualised

- The Federal Reserve started talking in June about the need to tighten monetary policy as the recovery continues and inflationary pressures rise. This caused a mini market tantrum in June (see later), but as set out last month, the direction of travel of the Fed has now changed from a loosening bias to a tightening bias. The forthcoming annual Jackson Hole annual jamboree of central bankers should provide better guidance on the Fed’s thinking.

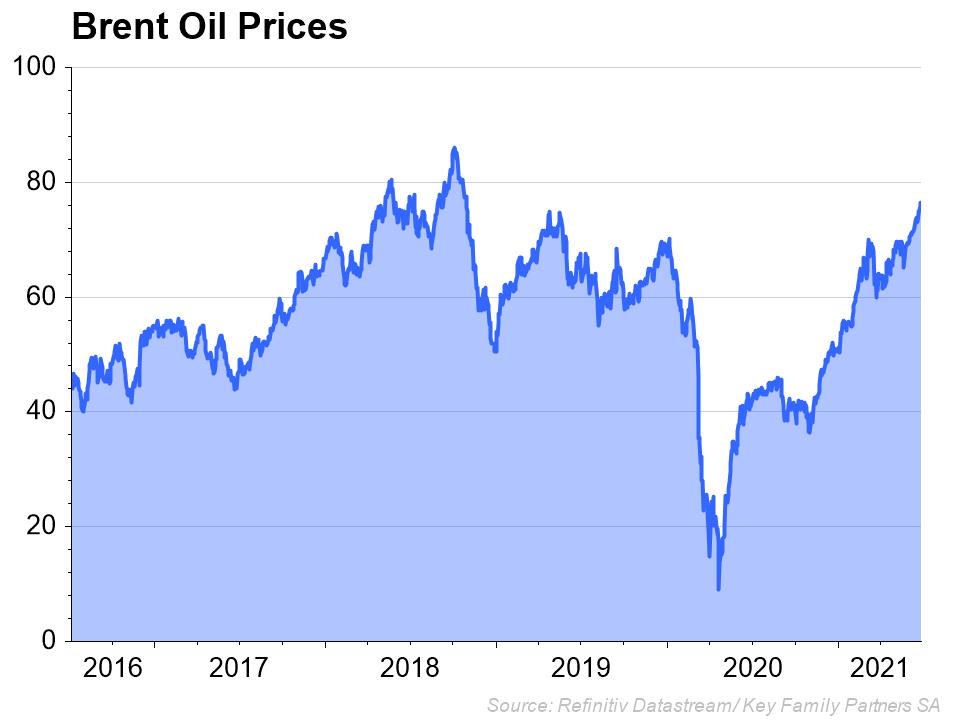

- The Oil price. We have often said that rising oil prices are a significant brake on economic growth. Today we are seeing oil prices rising once again for reasons that have been well covered – growing demand from the recovery but sluggish output growth and low investment. Petrol prices in the UK have risen to an 8 year high, for example.

- Continuing supply disruptions, at a time when consumer spending is rising in the recovery. This can be seen in the level of inventories held by retailers relative to sales; this ratio has fallen to a 30-year low in the US.

- Delayed economic re-opening due to the continuing spread of Covid through new variants. In some countries new lock down restrictions have been brought in which will slow the expected recovery, including in China which is seeing new sporadic outbreaks.

- Finally, leading economic indicators from numerous sources are now flashing warning signals of a growth rate slowdown on a global scale.

In summary, after seeing a strong recovery from the recession of 2020, economic growth is likely to slow from these elevated levels, towards a more normal, trend growth path.

Meanwhile on the inflation front…

The rise in inflation marches on across the global economy, with no sign yet of a pull back. Markit, the economic statistics provider (eg PMI data), for the first time specifically noted wage inflation in their data releases for June in both the US and Eurozone Core inflation in the US continues to surprise on the upside, with the May number coming in at 3.8% year on year vs 3.4% consensus. This number is one of the likely causes of the Fed’s decision to start talking about monetary tightening last month, somewhat earlier than the market had expected. As a result, market expectations of a first interest rate rise have moved in from 2024 to 2023 – and with a risk of even earlier action if growth and inflation continue to exceed expectations (the IMF base case).

While the US has seen the strongest acceleration in inflation amongst DM countries, core inflation rates are increasing across DM and EM economies. Producer prices are growing at alarming rates, with Germany’s PPI seen rising at 7.2% year on year in May, the highest level since the GFC in 2008/9.

The debate on the transitory nature of this global inflation surge continues, with Central Banks generally dovish (i.e. believing it will be transitory and keeping real interest rates negative), while independent commentators are becoming more hawkish.

In summary

- We can expect to see some slowing in the breakneck growth seen in the first half of the year as economies recover to pre-pandemic levels and trend growth rates.

- Inflation continues to exceed most expectations as energy prices and supply constraints continue to push up consumer prices

- However the rise in longer-dated US government bonds, since mid-May, may reflect investors doubts over longer-term growth and inflation.

For Investors…

- Equity markets are likely to see more downside risk as slowing growth would impact corporate earnings

- Portfolio hedging of equity risk through allocation to alternatives remains important

For more detailed commentary on each major market or asset class. Download the full Monthly Market View HERE.

Key Family Partners SA is a multi-family office based in Geneva, Switzerland. We serve our members with investment services, financial planning, administration, succession planning, education and philanthropy. Contact us at KFP@keyfamilypartners.com ~ +41 22 339 00 00 ~ Rue François-Bonivard 6, 1201 Geneva. https://www.keyfamilypartners.com/. Member of European Network of Family Offices – ENFO.

This article may contain confidential and proprietary information. Any unauthorised disclosure, copying, storage or use of this presentation may be unlawful. The content of this presentation does not constitute investment or financial advice and may not be relied upon as such. It does not constitute an offer or invitation for the sale or purchase of services or securities and shall not form the basis of any contract. Key Family Partners SA does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Key Family Partners SA is a private limited company with its registered office at Rue François-Bonivard 6, 1201 Geneva, registered with the commercial registry of Geneva under the IDE Nr. CH-395.573.747. KFP is a member of the Swiss Association of Asset Managers (SAAM).